by Ian McArthur | Mar 10, 2020 | Daily Results

Fundamental disruptions continue today, this time in the form of a risk transfer back onto stocks but I have a feeling this could just be temporary. With stocks being grossly oversold, there are some bargains in the short intraday term. This, with some aggressive profit taking in the form of liquidations from short contracts, have lifted stock prices in the short term. However with more horror stories of the Coronavirus I can see further sell offs in the near future.

Despite all this, there were still some excellent technical Dom trades from all our instruments.

We had another exceptional day with a maximum potential of 1.310 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 131 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

FTSE 100

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Mar 9, 2020 | Daily Results

This is one of the most volatile days I’ve ever seen in the markets in 14 years, along with some of the biggest gaps from the Fridays close to the open at 10pm GMT on Sunday. The Coronavirus has seen some of the biggest collective sell-offs of stocks across all the major indices. This however, has given strength to most currencies as risk is transferred away from the stock markets. The downside though is our individual currency strength balances have not been favourable, disrupting the price momentum by lack of divergence. Regardless there were still some excellent trades in our technical Dom directions, with increased volatility yielding above average points on both our currency pairs and some exceptional points from the German Dax.

We had a very exceptional day with a huge maximum potential of 2,130 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 213 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

The FTSE 100

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Mar 7, 2020 | Daily Results

Friday saw little improvement on overall trend momentum in currencies, as risk transfer is still away from stocks. Most individual currencies were on the strong side apart from and strangely enough, the USD which started and ended the day weak despite big selloffs in the Dow. This reflected in our ICS balance which saw the best price momentum in the GBP/USD, however lower volatility kept a lid on overall points. We had both Long and Short Doms in our GBP pairs with decent trades in both directions despite poor ICS Balances.

The EUR/AUD was technically Dom Long with good trades and obviously again, the German Dax was Dom Short on Coronavirus concerns despite very positive German Factory Orders data at 7am and some excellent points available.

We still had a very respectable day with a maximum potential of 1,015 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 101 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

As you can see, most stock indices are now pushing major supports.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Mar 5, 2020 | Daily Results

The Coronavirus is really hammering the stock markets again as more horror stories of the virus arise. This has caused a transfer of risk back on to currencies which played well for our Dom Long instruments, though individual currency balances were far from ideal. There were still some very good trades available, especially our early Jaths.

Of course, this caused casualties in the technically Dom Short EUR/AUD and Dom Long German Dax but there were a couple of trades before they turned.

Currency volumes were initially down until the risk started to move back from stocks and we saw a decent increase as the London session progressed.

We still had a decent day with a maximum potential of 530 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 53 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Mar 4, 2020 | Daily Results

Our GBP pairs were both Dom Long and Short today. There was always going to be some manic movement with lots of risk transfer away from most currencies to further bolster stocks. This ‘risk back on’ stocks also affected our initial Short Dom German Dax. High volatility UK Service data was also going to feature and this came in slightly negative.

All in all there were good trades in both technical Dom directions before fundamentals crept in.

We had a respectable day with a maximum potential of 730 points from specific Max Day Trading time/price level entries from the London morning session alone, with a target of just 30.

A 10% target of this figure would have yielded a minimum of 73 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 4, 2020 | Daily Results

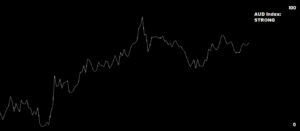

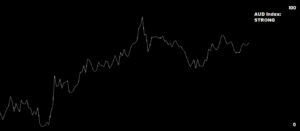

Our GBP pairs started the day Dom Short, which played well with early trades and the expected high volatility UK Manufacturing data at 9.30am, which surprisingly this came in positive. The result did little to the GBP/JPY but had a trend changing effect against the USD on a weakening dollar. However the huge surprise today was the strengthening of the AUD on an unexpected interest rate cut. This would normally drastically weaken a currency, which had me concerned of the accuracy of our AUD Index. However this strength was confirmed in a Forexlive article and it further showed against the GBP and also the EUR.