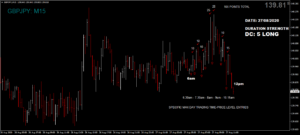

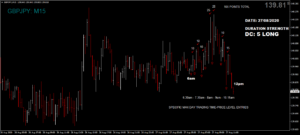

by Ian McArthur | Sep 2, 2020 | Daily Results

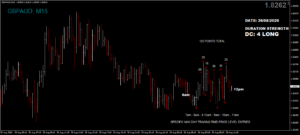

There was very little momentum within our currency strength indexes and this resulted in manic movements and some deep Domino channels with poor ICS Balances. We are now seeing (from yesterday) the pound being sold from the top of the Daily chart. Regardless, there were some good early trades, even in the Dom long GBP pairs.

The EUR/AUD also had a poor ICS Balance but the Doms ruled with some nice short trades at our usual times and a net short come the US open.

The weak euro played well with the Dom long German Dax and again we saw some superb points available.

Today we managed a decent maximum potential of 725 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 72 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

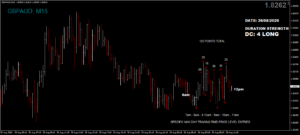

by Ian McArthur | Sep 1, 2020 | Daily Results

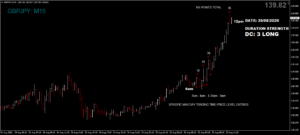

We generally had a strong pound today so we knew from the onset that our Dom short GBP/AUD was going to struggle. This was due to an equally strong AUD which was a major conflict within our ICS Balances. We still had some decent early short trades before the pound took dominance. Our other (long) GBP pairs did superbly with much better ICS Balances.

There was also a conflict within the EUR/AUD with 2 strong currencies battling it out. In this case, the long Doms took control on a weakening AUD due to some selling at the top of the Daily chart.

Swiftly on to the Dom short Dax. The first annoying part was advertised data on our ‘Investing’ calendar that failed to materialise at 7am. This is now scheduled for tomorrow. Secondly was an apparent data leak (again) of generally positive German data at 8.55am. This resulted in price rising from just under 1 hour before the announcement at a time we usually see selloffs. Once the data was released, the price was already built in and we saw some aggressive profit taking with the price dropping sharply. After this, the price ended up understandably net long come the US open.

Today we managed a decent maximum potential of 640 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 64 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 27, 2020 | Daily Results

Ordinarily it wouldn’t be easy trading the pound both long and short, however not with Max Day Trading. ALL GBP pairs traded very well in opposite directions and if is wasn’t for a sudden weakening of the GBP index in the last hour of the UK morning session, all indicated trends would have finished net in direction from the 6am time.

The EUR/AUD was Dom short with some very decent points available. The Dom long German Dax however ended slightly net short at the US open but not before some good early points at our usual trading times. Again the Dax is pushing H4 major resistance which is causing more sell-offs than usual. This and a lack of decent economic data (excluding the US) and low volumes are still causing consolidations and limiting overall point gains.

Today we managed another decent maximum potential of 550 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 55 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 26, 2020 | Daily Results

The markets continue to consolidate with very little trend and momentum in either direction. However our Dom trend predictions remain accurate, despite poor ICS Balances and again, low volumes are limiting overall points gains.

The only hiccup we had was with the German Dax, which started the day Dom short but a news item mid morning regarding GDP recovery lifted stock prices and the index ended slightly higher than the 6am level but still with some good early short trades.

Today we managed another reasonable maximum potential of 565 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 56 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

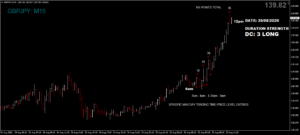

by Ian McArthur | Aug 25, 2020 | Daily Results

Lack of volumes and data is currently making the pound fairly non directional, having started the day as weak-ish and gaining strength once the UK opened. This, against a weak JPY saw about the best diversions between the currencies and the most relentless in the long trend. Other ICS Balances were not very good and this resulted in deep Domino channels but still with some decent points at our usual times.

As for the EUR/AUD, both currencies were weak on our Dom 3 long, with both currencies gaining strength throughout the morning. The AUD spiked up late on and hence the rapid fall in price leading to the US open.

The Dom long Dax held well with two lots of mainly positive data at 7am & 9am. However a 4 hour Major Resistance kept a lid on overall points.

Today we managed a reasonable maximum potential of 635 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 63 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Aug 24, 2020 | Daily Results

A fairly straightforward Monday with our Doms having to contend with some large movements from Friday. Individual Currency Indexes were neither strong nor weak apart from the GBP (weak), with no real deviations in any pairs. Despite this, there were still some good early trades at our specific times.

The controversy of today was the German Dax. This experienced a large fall on Friday, mainly due to Brexit talks. In my opinion, this distorted our Dom Cat 3, tilting it slightly down. This was registering as a Dom Cat 2 long at the UK open, which on the vast majority of occasions, would flip back to being short. However with the distortion and all other stock indexes trending long, I felt the Dom Cat 2 would extend to a 3 and this is why I gave this classification.

Today we managed a decent maximum potential of 700 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 70 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original 6am postings of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.