by Ian McArthur | Sep 15, 2020 | Daily Results

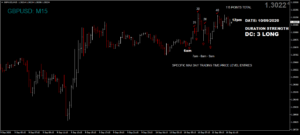

Fundamentals played a big part today, with high volatility UK and European announcements. 2 of our GBP pairs, the GBP/JPY & GBP/AUD were officially Dom short, with the data putting a spanner in the works from the earlier slot of 7am.

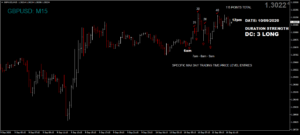

There were still some decent early trades against the data at our usual times but we knew it wasn’t wise to trade any later than mid morning. However the Dom long GBP/USD fared much better with some very good points available.

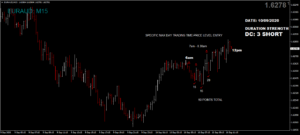

The Dom short EUR/AUD did surprisingly well with good points in the short direction, with the Doms overpowering positive EU data.

Last but not least our Dom short Dax, which looked more like a roller-coaster today with an 8am speech and positive data at 10am. Still some nice trades to be had.

Tuesday saw another reasonable maximum potential of 570 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 57 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 14, 2020 | Daily Results

A terrible day for our GBP pairs on very confusing Brexit fundamentals and spikes from Friday that distorted our all important Dom 3. These pairs were almost flat at the UK open, showing very little strength in direction with far from ideal ICS Balances.

To be fair, the Dom 3’s were tilting down slightly and this formed the final conclusion. Confidence remained fairly high in the short direction on an early article regarding a ratification of the Brexit withdrawal bill affecting the Irish border. This is being voted upon as I type, with a lot of controversy attached. Any amendments would be against the EU agreement which would normally see the pound plummet. We were informed that the amendments would pass but in a later article, the pound was gaining strength through the expectation of an ‘orderly’ exit and deal. A total contradiction and most certainly ‘popcorn time’ for the final vote. Despite all this, there were still a couple of early trades in each.

The EUR/AUD was a straightforward Dom long with some very good trades available but again, low currency volumes are restricting points.

The German Dax started the day Dom long but again, fundamentals crept in and we still had our usual good but manic points.

Monday saw a reasonable potential of 460 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 46 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 10, 2020 | Daily Results

There were some glaringly obvious choices today within our currency pairs regarding the all-important ICS Balances. We had full divergence within the GBP/JPY & GBP/USD with some very easy trade entries and points. Our conflicting pairs were the GBP/AUD and EUR/AUD, both pairs having strong currencies battling it out.

Another eye opener was the Dom strength of the GBP Index, which for the first time this week was strong from the UK open (Dom Cat 3 Long) and this lasted right up to the US open with good trades and points to be had. This made us aware that the Dom short GBP/AUD, which already had a bad ICS Balance, was going to struggle in the short direction but we still had a few early trades before the rot set in. Come the US open, the GBP took a big hit and followed the weakness we’ve seen since Monday, mainly due to Brexit fundamentals.

As mentioned, the Dom short EUR/AUD we knew would struggle but again, a few points were available.

The Dom long German Dax ended up relatively flat come the US open but we still had our usual manic trades.

Thursday saw another decent maximum potential of 645 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 64 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

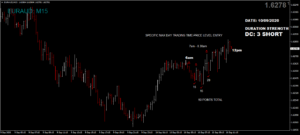

by Ian McArthur | Sep 9, 2020 | Daily Results

Fundamentals had all our GBP pairs pushing Major Support this morning and again, overall point gains were a little restricted. There were still some healthy points available but major levels can be somewhat sticky to get past.

The euro Index started the day ‘Flat Minus’ and this weakness continued to the US open. This didn’t bode well with our Dom long EUR/AUD but early trades were again unaffected.

The weakening euro also boosted stocks later in the morning and again this was against our Dom short German Dax but not before some very good short trades in the earlier hours.

Wednesday saw another decent maximum potential of 630 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 63 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

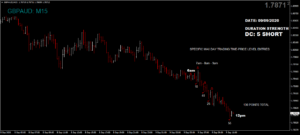

by Ian McArthur | Sep 8, 2020 | Daily Results

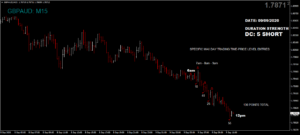

Brexit fundamentals and the increasing threat of a ‘no deal’ trade scenario is heaping pressure on the pound, as our left wing market movers dump the currency like there’s no tomorrow. This makes our short Doms even more predictable and we saw some very decent points in all our GBP pairs.

The Dom short EUR/AUD started to gain strength a good hour before the all-important Euro Block GDP, which low-and-behold was positive. Our early trades were unaffected by this and we saw some good points at our usual times.

The strengthening euro put the German Dax under pressure later in the morning but again, our early trades were unaffected with some very healthy points available.

Tuesday saw another decent maximum potential of 790 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 79 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

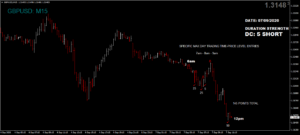

by Ian McArthur | Sep 7, 2020 | Daily Results

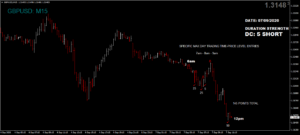

Low volumes and lack of data is keeping a lid on point gains within our currency pairs but at least our Doms are behaving very well, as usual. The GBP index remains under pressure as Brexit negotiations edge closer to a ‘no deal,’ which reflected in all our GBP pairs being Dom short, with good trades available in all.

The Dom short EUR/AUD did well on negative German data but strangely the demise of the euro, being usually good for the Dax, still had the Dax rising. The only information I could find was an article on German industrial firms expecting output to rise in the coming months. Regardless there were some excellent, though manic points at our usual times.

Monday saw a decent maximum potential of 825 points from specific Max Day Trading time/price level entries from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 82 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.