by Ian McArthur | Oct 6, 2020 | Daily Results

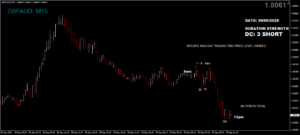

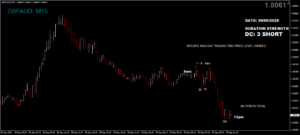

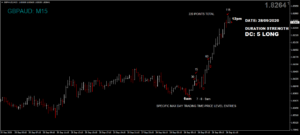

Yet another day where fundamentals had a big influence on our technical Doms, some good and some bad. The GBP Index started the day with some decent strength, which was boosted by positive UK data at 9.30am. Our early trades suffered a little with pre-news selloffs but overall all our Dom long GBP pairs gave some good points. However just before the end of the UK morning session, the pound literally dropped off a cliff on Brexit and interest rate talks.

The Dom long EUR/AUD gave some very decent points on mixed EU data but we saw some big swings on the Dax on initially positive German data, followed by negative data later in the morning.

Tuesday saw another decent maximum potential of 660 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 66 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Oct 5, 2020 | Daily Results

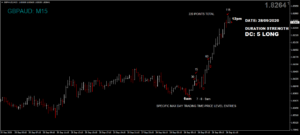

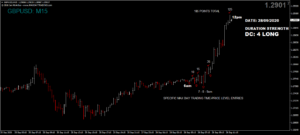

The markets and especially the GBP seem to be in a state of ‘limbo,’ stuck between indecision regarding Brexit and coronavirus. Individual currency strengths themselves were lacking overall direction and this in turn is causing reduced momentum within our trends. The pound started the day ‘strong ish’ but was further boosted by positive UK data at 9.30am, eventually giving all our Dom long GBP pairs some very decent points.

Positive EU data put a spanner in the works of our Dom short EUR/AUD and although there were a few early trades, ICS Balance would have put this pair at the back of the queue.

The strengthening euro restricted overall gains in the Dom long Dax and that was despite positive-minus (actual below previous) German data, giving our usual manic though decent points.

Monday saw a decent maximum potential of 655 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 65 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Oct 1, 2020 | Daily Results

Brexit fundamentals played a huge part of our trading today with two specific articles. Firstly a news item portraying difficulties in trade negotiations between the UK and EU saw the pound drop of a cliff. This affected the whole of the UK morning session and our technical Doms until just after 12pm. Shortly after, a second article appeared mentioning a compromise and the pound shot up again, reversing earlier losses. This was on the back of an initially strong GBP Index.

The initial article put a spanner in our Dom long GBP/JPY and GBP/USD pairs but not before some decent early points at our usual times. However our Dom short GBP/AUD did exceptionally well.

The euro started the day weak so there was little disruption in the Dom short EUR/AUD but the the Dom long Dax suffered from the Brexit news and also negative German data. Good points were still available.

Despite all this, Thursday saw another decent maximum potential of 700 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 70 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 30, 2020 | Daily Results

High volatility data made a comeback today covering all our instruments from the 7am UK open. Despite being positive on most counts, our long and short Doms remained pretty much as they were. This included all our GBP pairs, the EUR/AUD and German Dax with good, though slightly manic points in all.

Wednesday saw another decent maximum potential of 865 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 86 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Sep 29, 2020 | Daily Results

Currency volumes remain stubbornly low and a lack of economic data is showing in our ICS Balances, with little momentum anywhere. Our GBP pairs were both Dom long and short today with decent points in both directions at our usual times.

The Dom short EUR/AUD had some good points and the weak euro should have benefited the Dom long German Dax but this struggled from the UK open. Two possibilities for this was an article citing coronavirus concerns, with also a hint of political uncertainty surrounding Brexit and German data that was due out at 13.00. All in all there were still some good points but entries were a little more tricky than usual.

Tuesday saw a greatly reduced but decent maximum potential of 605 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 60 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

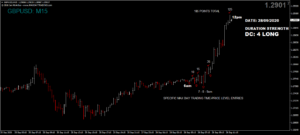

by Ian McArthur | Sep 28, 2020 | Daily Results

Despite some initially poor ICS Balances, all our Dom long GBP pairs did exceptionally well today with very good and easy points available. The same can’t be said for the EUR/AUD. Again there was a conflicting ICS Balance but the Domino Channel itself was very deep, indicating very manic movements. Early trades were fair but this pair wouldn’t have been one of our top choices.

We had a bit of a dilemma with the German Dax which started the day with a virtually flat Dom 3. Should we trade long or short? Let’s look at the evidence; Dom 1 & 2 relentless long (not usually tradable), euro generally weak (good for stocks), Dow & CHN50 both trading long. Long it was with some excellent points to be had.

Monday saw a very healthy maximum potential of 1,005 points from specific Max Day Trading time/price level entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A 10% target of this figure would have yielded 100 net points from specific Max Day Trading time/price level entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.