by Ian McArthur | Dec 1, 2020 | Daily Results

Brexit trade negotiations continue to see-saw the pound, making trades difficult but still feasible especially at our usual times. We have had to endure positive and negative statements from conferences within the space of just a few hours. Not good but however we still managed some good points in all our Dom long GBP pairs on early positive UK housing data, despite poor ICS Balances.

There were also good points from our Dom long EUR/AUD and German Dax on mainly positive economic data.

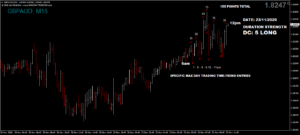

Tuesday saw another decent maximum potential of 585 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 58 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 30, 2020 | Daily Results

Brexit trade negotiations had the pound on a roller-coaster ride again, from an extension of weak from yesterday to strengthening on more positive talks as the morning progressed. This caused poor ICS Balances at the start of the UK open which made our early trades a little tricky. However our usual trades from 7am yielded some good points despite the stronger pound taking control later on.

The Dom long EUR/AUD had by far the best ICS Balance and this reflected in a steady climb up to the US open at 12pm GMT, 7am EST with some decent points on low volumes.

The ‘nail biter’ today was the German Dax, which started the morning at the bottom of the chart and would usually see this type of downward movement continue. However our Dom technical conclusions told us otherwise and the price made strong gains throughout the morning with excellent trades available.

Monday saw a decent maximum potential of 510 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 51 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 26, 2020 | Daily Results

Another very frustrating day for our technical Doms as further announcements regarding Brexit and Covid put a spanner in 4 out of 5 of our instruments. All our currencies were Dom long and the news weakened both the pound and euro. This was exasperated by poor ICS Balances and very low volumes in most pairs. Thankfully our early trades did fairly well and some decent points were still to be had before the rot set in.

The news also affected the Dom short Dax, along with early German data but volumes remain painfully low.

Thursday saw a greatly reduced maximum potential of 270 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 27 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 25, 2020 | Daily Results

Again we had to suffer Brexit news today with comments that a trade deal may not be reached. Of course UK market movers immediately started to dump the pound, disrupting our Dom long GBP pairs but thankfully enhancing our Dom short GBP/AUD.

This news also weakened the euro, playing nicely for our Dom short EUR/AUD but hampering our Dom long German Dax. Again we are suffering very low volumes which are limiting our overall gains.

Wednesday saw another reasonable maximum potential of 460 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 46 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 24, 2020 | Daily Results

The pound continued to strengthen on signs of a Brexit trade deal with the EU, giving our Dom long GBP pairs a nice boost. The only casualty was the GBP/AUD with an equally strong, if not stronger AUD, giving us an ICS Balance conflict. Regardless, points at our usual times were still decent.

The Dom short EUR/AUD gave some good points, as did the Dom long German Dax on two lots of positive data. However overall currency and stock volumes remain low for this time of year and are probably linked to the ‘waiting game’ between the US elections and an EU trade deal.

Tuesday saw another reasonable maximum potential of 480 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 48 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Nov 23, 2020 | Daily Results

Up and coming UK & German data did little to disrupt our technically long Dom GBP pairs and the Dax, while the Dom short EUR/AUD played out well until positive data lifted the price approaching the US open.

There was no surprise of the outcome of the German news, with the price increasing up to the announcement of mixed though positive data.

Monday saw a reasonable maximum potential of 690 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 69 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.