by Ian McArthur | Dec 10, 2020 | Daily Results

The ongoing EU trade negotiations and lack of compromise continues to weaken the pound, giving a boost to our Dom short GBP pairs and making us realise that the Dom long GBP/JPY wasn’t going to yield many points. However there were still a few early trades before fundamentals took a hold.

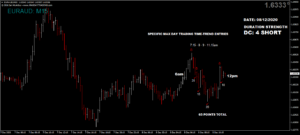

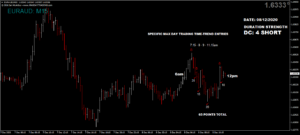

The Dom short EUR/AUD gave some great points but the weak euro didn’t help the Dom short German Dax, with reduced though decent points available.

Thursday saw another respectable maximum potential of 630 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 63 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 9, 2020 | Daily Results

For the second day in a row, Brexit trade negotiations were on the optimistic side again, benefiting our Dom long GBP pairs. This would normally lift the euro too but we had an ICS conflict in the Dom short EUR/AUD with similar strength currencies dookin it out, with the Doms ruling as usual.

The Dax benefited not only from the weak euro but also positive news on the Covid vaccine.

Wednesday saw another respectable maximum potential of 715 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 71 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 8, 2020 | Daily Results

The markets were very much in limbo today, more especially the pound as EU trade talks drag on. There were undertones of negativity which extended from yesterday and continued while reporters awaited any breakthroughs. This bode well with our Dom short GBP pairs for the remainder of the UK morning session, as positive news didn’t come out until approx. 1pm GMT, sending the pound higher.

The Dom short EUR/AUD had a poor ICS Balance with little momentum and wouldn’t have been trading choice but there were still some decent trades at our usual times.

The Dom long Dax suffered a little on the lack of EU trade negotiation conclusions, along with mixed German economic data earlier in the morning.

Tuesday saw another respectable maximum potential of 710 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 71 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 7, 2020 | Daily Results

For a refreshing change, Brexit fundamentals boosted our already Dom short GBP pairs, as trade negotiations drag on without agreements on key issues. This gave us some easy entries and excellent points at our usual times.

The Dom short EUR/AUD suffered a little with positive data and an unusual weakening of the ADU after the UK open and the Dax was its usual manic self with a combination of EU trade talks and positive German data at 7am.

Monday saw a very respectable maximum potential of 805 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 80 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 3, 2020 | Daily Results

The majority of our GBP pairs were borderline trends, being a Dom Cat 2 long with the Dom Cat 3 (pivot) showing only a shallow short. This was due to extended optimism from the conclusion of last nights’ Brexit trade negotiations, giving the GBP Index an initial ‘weak plus’ which continued throughout the morning. Positive UK data at 9.30am rounded off the pounds’ strength with some safe ‘post news aftermath’ trades in the long direction. There was however some good early trades in the Dom short direction before the news.

The Dom short EUR/AUD and Dax gave some decent points too on mixed EU Block and German data.

Thursday saw another decent maximum potential of 585 points on reduced trades from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 58 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 2, 2020 | Daily Results

Another very frustrating day where Brexit fundamentals disrupted our currency pairs, (all Dom long) though benefiting the Dom short Dax. Even early positive German data wasn’t enough to overpower the short Doms, with the Dax plummeting on 7am release. This, along with all our currencies took a further hit just after 8am with a statement release on unfavourable EU trade negotiations. This nullified our 8am trades in all our GBP pairs but we managed to squeeze an 8am trade from the EUR/AUD. Despite this ALL our early trades did well, with the Dax yielding right up to the end of the UK morning session.

Wednesday saw another decent maximum potential of 485 points on reduced trades from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 48 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel ‘Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.