by Ian McArthur | Dec 22, 2020 | Daily Results

Fundamentals played their part today, giving a well needed boost to all our currencies pairs on poor ICS Balances. The exception was the Dom short Dax having positive German data, causing an intraday trend change to long.

Tuesday saw a decent maximum potential of 945 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 94 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

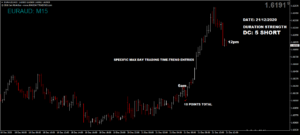

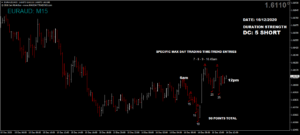

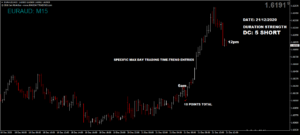

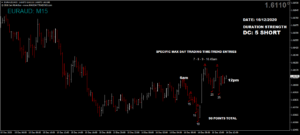

by Ian McArthur | Dec 21, 2020 | Daily Results

ICS Balances played a big part in instrument choice today, with top scores going to the Dom long GBP/JPY & GBP/USD with best divergence. Third on the list was the Dom long GBP/AUD, with a weak GBP against a weak-ish AUD. Still some decent points to be had. Dead last was the Dom long EUR/AUD, with equally weak currencies battling it out. Clearly the AUD ended up the weakest, sending this pair long from a Dom Cat 2 in the Asia session to eventually a Cat 3.

The Dom short German Dax did very well on negative EU trade talks and Covid infection rates.

Monday saw a very decent maximum potential of 1205 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 120 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 17, 2020 | Daily Results

There were some obvious choices before we even started today regarding ICS Balances. We knew to avoid any Dom long pairings with the AUD, as this itself was strengthening from positive AU data at 00.30am. Better balances were found in the GBP/JPY and especially the GBP/USD, which we knew before we traded. The worst was the EUR/AUD as we had 2 strong currencies battling it out. Again we were fully aware of this at the UK open.

The Dom long German Dax gave some slightly less manic points today, as the limbo continues with trade talks.

Thursday saw a reasonable maximum potential of 530 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 53 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 16, 2020 | Daily Results

The pound continues to err on the positive side, as EU trade talks continue to make steady progress but fisheries still remain a sticking point. Our Dom long GBP pairs fared very well under the circumstances with good points available in all.

There was a bit of a hiccup with the Dom short EUR/AUD with positive EU data but we still had some decent points at our usual times. There was also generally positive German data which further lifted the German Dax, giving excellent points up to the end of the UK morning session.

Wednesday saw another decent maximum potential of 865 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 86 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 15, 2020 | Daily Results

The pound took another roller-coaster ride today as EU trade negotiations continue with both positive and negative tones. The euphoria from yesterday didn’t last long, with the GBP index starting the day as flat minus. Even positive UK data at 7am did little to lift the pound until more positive tones filtered through from the trade talks by mid morning.

There was a better ICS Balance within the Dom long EUR/AUD but momentum was still fairly poor. Even the Dom long German Dax didn’t yield the big points as it usually does, confirming that the markets are still in consolidation mode until something solid happens regarding a deal or no deal. Either way will see a big jump in volatility.

Tuesday saw a decent maximum potential of 730 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 73 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.

by Ian McArthur | Dec 14, 2020 | Daily Results

Fundamentals dominated our GBP pairs again today but this was in contrast to the weak pound of last week. This was owing to an increasing risk of a no deal in trade negotiations with the EU leading up to Sundays deadline (yesterday). However during Sundays negotiations it was decided to extend (again) the deadline to try and avoid a no deal scenario. This resulted in a large spike, which gapped our charts North at the official open on Sunday night (GMT) and continued throughout the UK morning session, helping our technical long Doms.

The Dom short EUR/AUD again had a very poor ICS balance and this showed in the manic movements that occurred. There was also a conflict with the German Dax, which technically was still Dom short from Friday. EU trade talks lifted the price as expected and more in line with the Dom long US DOW30.

Monday saw a decent maximum potential of 685 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 68 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

For the original postings at 6am of the above instruments, join out free Telegram channel; Trade Forex With MaxDayTrading. Full details below.

For those who have not joined either our Free Telegram Channel or VIP Channel why not come and see how we do what we do? Go to our homepage to find out full details.