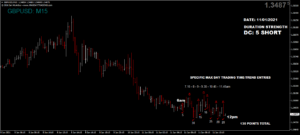

by Ian McArthur | Jan 19, 2021 | Daily Results

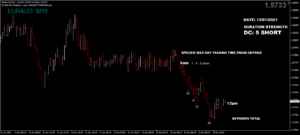

Currency volumes are unusually low at the moment, possibly due to market movers being away from their offices and/or the US inauguration tomorrow. ICS Balances were good in some pairs and not so good in others. The decent ones were the GBP/JPY and the GBP/USD to a certain degree with fair points available in all.

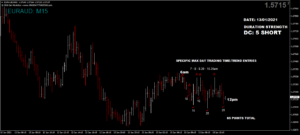

The ICS Balance conflict continues within the Dom short EUR/AUD and I issued a warning against this pair as being ‘borderline.’ The strengthening euro also kept a lid on overall gains in the German Dax.

Tuesday saw another reasonable maximum potential of 455 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 45 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

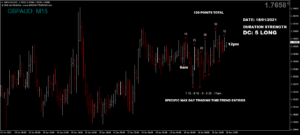

by Ian McArthur | Jan 18, 2021 | Daily Results

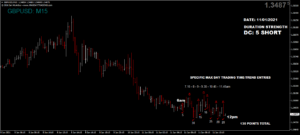

ICS Balance played a big part in our choices of which GBP pairs to trade. There was good divergence in the Dom short GBP/JPY & GBP/USD pairs and this is where we saw the best momentum. However the highest points came courtesy of the Dom long GBP/AUD but here the price was quite manic and not the easiest to trade.

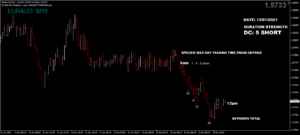

The Dom short EUR/AUD gave some decent and straightforward points and again, we saw a ‘blip’ in the manic and Dom short German Dax, possibly on the announcement that their Covid infection cases were at the lowest since last September.

Monday saw another reasonable maximum potential of 595 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 59 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

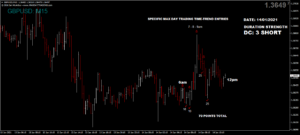

by Ian McArthur | Jan 14, 2021 | Daily Results

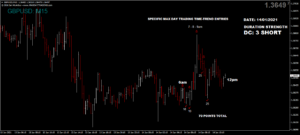

The UK pound started to lose the strength it had built up over the last couple of days, changing our GBP pairs from Dom long to short. However the pound wasn’t outright weak and this caused quite a bit of ranging in most pairs, however with some decent points still available in all.

The Dom short EUR/AUD was a little more definitive with a better ICS Balance, though still ranging a little. Last but not least, the Dom long German Dax did well at our usual times but lost quite a bit of strength leading up to the US open at 12PM GMT.

Thursday saw another reasonable maximum potential of 515 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 51 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

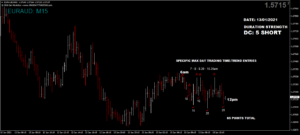

by Ian McArthur | Jan 13, 2021 | Daily Results

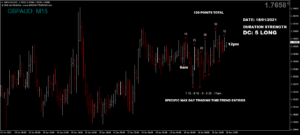

The UK pound continued with yesterdays strength, making all our GBP pairs Dom long yet again with good points available in all.

Again we had a Dom short EUR/AUD with a far from ideal ICS Balance but in the end, the Doms took hold and ruled yet again. The German Dax was more ranging but officially Dom short with good points at our usual times.

Wednesday saw another decent maximum potential of 545 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 54 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jan 12, 2021 | Daily Results

In contrast to yesterday, the UK pound started off strong and this continued throughout the UK morning session. This reflected in our Dom long GBP pairs, though ICS Balance weren’t ideal.

The Dom short EUR/AUD did very well, as did the Dom short German Dax with good points available in both.

Tuesday saw another decent maximum potential of 705 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 70 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jan 11, 2021 | Daily Results

The general strength of the pound started off weak-ish today and the decline continued until the end of the UK morning/US open session. Focus therefore would have been on our Dom short GBP pairs, with caution towards the Dom long pair. The best ICS Balance by far was the GBP/USD and this is where our best points came from.

There was an ICS Balance conflict within the Dom long EUR/AUD and this was evident in the lack of momentum and eventual points. The Dom short German Dax had a little more momentum and some very good, though manic points available.

Monday saw a decent maximum potential of 600 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 60 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.