by Ian McArthur | Feb 9, 2021 | Daily Results

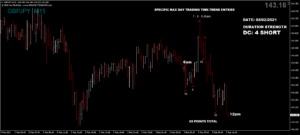

The UK Pound started the day as strong-sh on positive housing data in the early hours (just after midnight), which gave us both long and short trends in our GBP pairs. We also had some good and not so good ICS Balances within all our currency pairs, especially the EUR/AUD as positive EU data lifted the euro against an already strong Australian Dollar. Volumes still remain painfully low.

The tricky one today was the Dom short German Dax on positive Trade Balance data at 7am. However again, the Doms ruled and the short trend continued until late in the UK morning session.

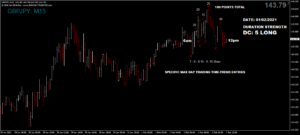

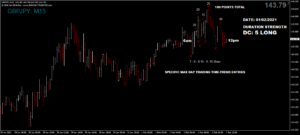

Tuesday saw an improvement from yesterday with a maximum potential of 415 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 41 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

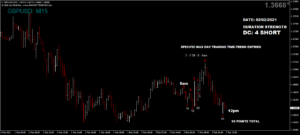

by Ian McArthur | Feb 8, 2021 | Daily Results

Trading volumes in both currency pairs and stock indices are extremely low for this time of year, which is very strange to say the least. It’s as if the markets are in limbo and waiting for something major to happen, the big question is what?

These volumes are causing poor ICS Balances and little momentum in price, reflecting in greatly reduced points from all our instruments.

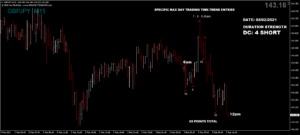

Monday saw a very poor maximum potential of 375 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 37 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 4, 2021 | Daily Results

We had good and not so good ICS Balances within our currency pairs today, with excellent points in all our early trades at our usual times and this is despite low overall volumes.

Our Dom short GBP pairs saw a huge spike on expected Interest Rate and QE data right at the end of the UK morning session at 12pm.

The German Dax gave some good points also and again, price movement was manic but well within our Dom conclusions.

Thursday saw another decent maximum potential of 565 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 56 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 3, 2021 | Daily Results

Individual currencies themselves are suffering low volumes and lack of definitive strength or weakness. This in-turn is causing poor ICS Balances and little in the way of momentum. Our early trades fared well but entries were not well defined.

Yet again, our best mover was the German Dax but even here, volumes were down and points limited. The markets still seem to be waiting for something major to happen. The question is, what?

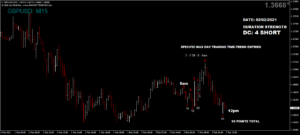

Wednesday saw another decent maximum potential of 465 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 46 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 2, 2021 | Daily Results

Again there were ICS Balance conflicts in most of our currency pairs, especially GBP/AUD but again we were fully aware of this before our trading session started. However there were still decent points available though entries were a little tricky.

The Dom long German Dax gave the best points again but this is by far not for the faint hearted!

Tuesday saw another reasonable maximum potential of 540 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 54 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 1, 2021 | Daily Results

ICS Balances and Negative German data made trading all of our instruments somewhat difficult today. However our Dom trend directions and timed entries did fairly well under the circumstances with decent points available in all.

Monday saw a very reasonable maximum potential of 745 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 74 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.