by Ian McArthur | Feb 18, 2021 | Daily Results

Early articles stating the largest drop in Coronavirus cases with a drastic reduction since January spiked the UK Pound against our Dom short GBP pairs. There were one or two early trades but it was clear that the intraday sentiment and trend had definitely flipped from short to long. ICS Balances were irrelevant in these cases.

There were steady points from the Dom short EUR/AUD and the usual manic points from the Dom short German Dax.

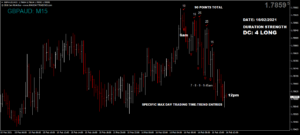

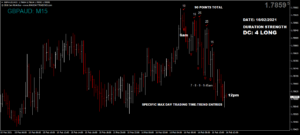

Thursday saw a reduced maximum potential of 465 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 46 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 17, 2021 | Daily Results

Early UK economic data, far from ideal ICS balances within our currency pairs and GBP pairs trending in both directions gave us a roller-coaster ride today. Yet again, our Doms (in both directions) shone through with decent trades at our usual times. Volumes remain low.

Early and positive German Covid data gave an initial boost against our Dom short Dax but it wasn’t long before the Doms took over with some good short trades at our usual times.

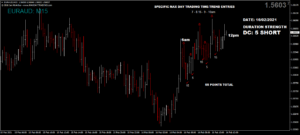

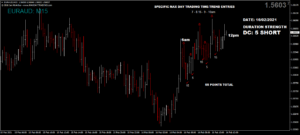

Wednesday saw a decent maximum potential of 535 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 53 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 16, 2021 | Daily Results

ICS Balances within our currency pairs weren’t the best today and in turn, trend momentum and entries were a little difficult but points were still available at our usual times. Currency volumes remain extremely low.

Positive EU and German economic data also went against our Dom short EUR/AUD and it appeared we had a pre-news selloff of the Dax before data sent the price higher. Despite this, decent points were still available at our usual times.

Tuesday saw an improved maximum potential of 450 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 45 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 15, 2021 | Daily Results

ICS Balances were better today and for a change we saw, what appeared to be some decent trends within a few of our currency pairs. However again, trading volumes are horrendously low for this time of year and this is keeping a firm lid on overall point gains. Todays’ numbers were far better but this was only due to decent ICS Balances. In fact the additional momentum caused major resistance to be breached in both the GBP/JPY & GBP/USD.

Monday saw an improved maximum potential of 400 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 40 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 11, 2021 | Daily Results

Individual currencies themselves are continuing their consolidation themes, with little momentum anywhere and painfully low volumes keeping overall point gains to a minimum. ICS Balances in all currency pairs were far from ideal too.

The Dom short German Dax broke higher on positive economic data, making trades a little tricky.

Thursday saw a fairly poor maximum potential of 310 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 31 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 10, 2021 | Daily Results

ICS Balances within our currency pairs was better today and we had what at first appeared to be decent momentum. However low trading volumes are keeping overall gains down to a bare minimum. Despite this there were still decent points available at our precise times.

The technically Dom long German Dax went totally against the grain in the early hours on Covid restrictions that are going to last until mid March at the earliest.

Wednesday saw a reasonable maximum potential of 470 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 47 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.