by Ian McArthur | Mar 11, 2021 | Daily Results

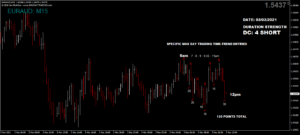

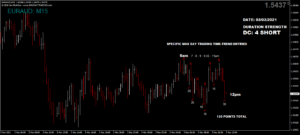

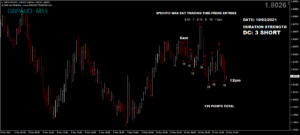

Again, ICS Balances were not ideal today, which also saw our GBP pairs trending in both the long and short direction. Good points were still available at our usual times albeit again on much lower volumes for this time of the year.

There was a major ICS Balance conflict in the Dom short EUR/AUD and this reflected in little momentum and difficult entries.

The German Dax was up to its usual tricks but still gave us some decent points at our usual times.

Thursday saw another reasonable maximum potential of 555 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 55 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 10, 2021 | Daily Results

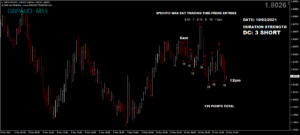

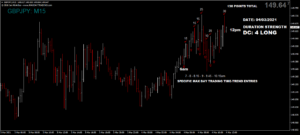

Due to very weak individual currencies, our GBP pairs were trending in both the long and short direction on poor ICS Balances. Volumes have dropped yet again, restricting our overall points. However despite all this, Our technical Dom trades gave some excellent, though limited points at our usual times in all our instruments.

Wednesday saw another reasonable maximum potential of 620 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 62 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 9, 2021 | Daily Results

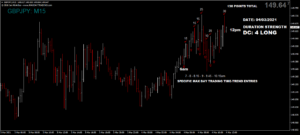

Individual currencies are themselves lacking definitive strength or weakness, reflecting in poor momentum and direction once paired together. Focus was again on the Dom long Dax once negative German economic data was absorbed from 7am.

There were still some very decent points to be had within our currency pairs at our usual trading times.

Tuesday saw another reasonable maximum potential of 625 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 62 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 8, 2021 | Daily Results

ICS Balances within our currency pairs were terrible today, with the Doms battling some and not others. This made it difficult to choose a pair that would yield good points from the open. In hindsight, the GBP/JPY & GBP/USD ended up being the best.

This put emphasis again on the Dom long German Dax for our points today and thankfully this delivered despite negative data at 7am.

Monday saw a reasonable maximum potential of 660 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 66 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 4, 2021 | Daily Results

Individual currencies themselves lacked overall strength or weakness and this in turn reflected in lower currency pair momentum. Volumes seemed to have dropped a little too. Despite all this, our Dom trend directions in all instruments held up very well with good points available.

Thursday saw another reasonable maximum potential of 760 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 76 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Mar 3, 2021 | Daily Results

Within our GBP pairs, two had decent ICS Balances, the GBP/JPY & GBP/USD. The odd one out was the GBP/AUD as two fairly strong currencies battled it out. There was a similar story with the EUR/AUD, restricting overall price movement.

The beauty was we knew these momentums before the UK had even opened! The only spanner in the works was negative UK economic data at 9.30am which saw some selloffs leading to the end of the morning session.

The Dax seemed to shrug off negative German economic data at 8.55am, with the Dom long trend lasting most of the morning.

Wednesday saw another reasonable maximum potential of 630 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

A TEN PERCENT target of this figure would have yielded 63 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.