by Ian McArthur | May 18, 2021 | Daily Results

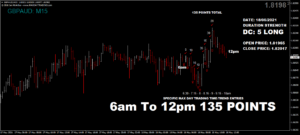

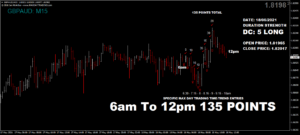

ICS Balances were a little more favourable today though far from ideal. Our Dom GBP pairs moved the best on mixed though positive UK economic data at 7am. However the UK pound still remains in an overbought scenario and we never know when market movers are going to take profit and drive the price back down.

The EUR/AUD had an exceptionally bad ICS Balance as the euro gained strength throughout the UK morning session. There was also the Dom long Dax which struggled on poor NASDAQ figures and a strengthening EUR Index. Overall there were still some decent points at our usual times and again, volumes remain painfully low.

Tuesday saw a slight improvement on yesterday with a maximum potential of 550 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 55 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 17, 2021 | Daily Results

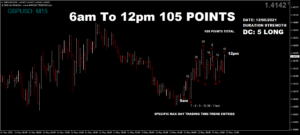

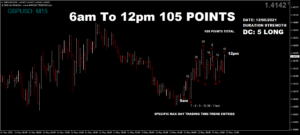

We literally had a repeat of Friday with our currency pairs, with all individual indexes on the strong side. This lack of diversion most definitely slows momentum down and prices become manic, as similar strength currencies battle it out. It’s not ’till we get some sort of diversion of strengths (weak -v- strong) that we then see definitive movements in the Dom long or short trends.

We had to depend on early trades at our usual times to get any decent points today and this was further hampered by continued low volumes. Even the Dom long German Dax was hampered by a strong euro but overall there were still some good points available.

The start of the week saw a reduced maximum potential of 480 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have still yielded 48 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 13, 2021 | Daily Results

The GBP is now beginning to lose steam now as market movers liquidate and take profits. This is making ICS Balances unfavourable and today we had our GBP pairs trending in the long and short direction. There were still good points available in our 3 GBP pairs at our usual times.

The Dom long EUR/AUD took most of its trend from a weak AUD rather than a strong EUR and again we had some good trades.

There was an initial warning in VIP of a ‘borderline’ German Dax which was also trending against the US DOW30. Come the 7am UK open, it was evident that the trend was short and combined analysis reflected this with some superb points available.

Thursday saw another decent maximum potential of 970 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 97 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 12, 2021 | Daily Results

The GBP remains in an overbought state as UK economic data continues on its positive path. This gave an automatic exclusion of the Don short GBP/JPY but even here we had some decent trades at our usual times.

A poor ICS Balance kept momentum down in the Dom long EUR/AUD and we had a countertrend from the initially Dom short Dax on expected German data which was above last weeks previous figure.

Wednesday saw another decent maximum potential of 695 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 69 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 11, 2021 | Daily Results

The GBP has been constantly pushing the H4 resistance level and is well overbought at the moment. This however is not affecting our Dom trend directions with good trades available in all our GBP pairs, albeit yielding restricted points with little room to manoeuvre.

The Dom long EUR/AUD had a poor ICS Balance but for a change yielded some decent points, as did the star of the Day – the Dom short Dax which totally ignored positive German data in the early hours.

Wednesday saw a very decent maximum potential of 780 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 78 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 10, 2021 | Daily Results

The Max Day Trading technical analysis shone through superbly today, with all eyes on the Dom long GBP/JPY – GBP/USD and the Dom short EUR/AUD with an immediate dismissal of the GBP/AUD. This is a combination of the power of ‘The Domino Effect’ and the beauty of ‘The ICS Balance.’ When these are in harmony, intraday trends are relentless and trades are very easy. Even the Dom short GBP/AUD with a terrible ICS Balance gave some decent points at our usual times but much easier trades were available elsewhere.

The Dom long German Dax faltered today on very poor US NFP data on Friday but we still had some good points in the early hours.

Monday saw a decent maximum potential of 595 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 59 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.