by Ian McArthur | May 27, 2021 | Daily Results

Volumes and momentum remain horrendously low and coupled with poor ICS Balances as weak indexes battle it out, price movements within technical Dom trend directions remains manic. I don’t care what intraday strategy you may be using at the moment, points are difficult to gain as trend predictions become harder because of low volumes. There was a brief boost to the UK pound as the central banks hint on an interest rate rise. However in 15 years of trading, I’ve never seen the markets as bad as this and have seen far higher volumes at the height of the summer and Christmas holidays. What on earth are the markets waiting for ???

Rant over! Despite this, there were still some decent trades at our normal times in all our instruments.

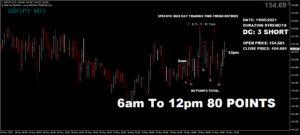

Thursday actually saw another slight increase on yesterday with a maximum potential of 520 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 26, 2021 | Daily Results

We were fully aware before the UK open today that momentum within currency trends was going to be minimal, and this fact didn’t disappoint but the lack of points did! There were still dome decent earlier trades at our usual times but again, volumes are painfully low for this time of year.

The star of the show again was the Dom short German Dax and here we had our usual manic though very decent points.

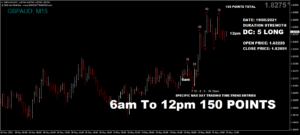

Wednesday saw a slight increase on yesterday with a maximum potential of 510 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 51 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 25, 2021 | Daily Results

The UK pound started the day on the weak side so any Dom long pairs were attributed to an even weaker partner. By mid morning, negative CBI Retail figures dragged the pound further down come the US open. Despite this, our GBP pairs were trending both long and short with good points in all on reduced volumes.

The Dom short EUR/AUD went off the boil by mid morning with positive German data that lifted the euro. Still some decent early trades at our usual times.

The Dax had a bit of a roller-coaster ride with early negative German economic data and late positive data. Volumes here are well down too with decent but restricted points.

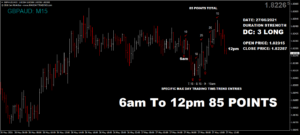

Tuesday saw a slightly reduced maximum potential of 465 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 46 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 24, 2021 | Daily Results

Despite some terrible ICS Balances, our technical Dom directions did very well this morning with good trades in both the long and short direction. Volumes remain low and this was unusually evident in the German Dax which usually yields double and triple the gains of today.

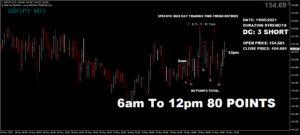

The start of the week saw a reasonable maximum potential of 590 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 59 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 20, 2021 | Daily Results

The markets are still suffering from unusually low volumes, which have plagued us since the beginning of January. After the Christmas holidays the markets were expected to liven up to some of the biggest volumes of the year. So far, I’ve seen bigger volumes at the height of the Christmas and summer holidays. What are they waiting for ??

Unfortunately low volumes offer little trend momentum, as individual currencies battle each other with sticks instead of explosives! Despite all this, trades were generally still fairly plentiful at our usual times.

Thursday saw a reduced maximum potential of 605 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 60 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | May 19, 2021 | Daily Results

Our GBP pairs were trending in both the Dom long and short directions with poor ICS Balances. Points were still available at our usual times but again, volumes remain very low.

One of the best ICS Balances for a change belonged to the Dom long EUR/AUD and here we had some very decent points available. The strong euro played well for the Dom short German Dax and it was here we made up for lost time with excellent points to be had.

Wednesday saw an additional improvement on yesterday with a maximum potential of 770 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 77 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.