by Ian McArthur | Jun 22, 2021 | Daily Results

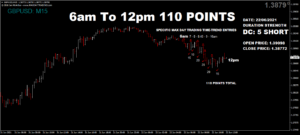

The GBP Index continued its technical rebound from Monday but I was still dubious how long the strength would last in the light of negative Covid fundamentals. Despite this there were decent points available in all our GBP pairs, trending both Dom long and short.

The Dom long EUR/AUD did well on a poor ICS Balance, as did the Dom long German Dax which struggled a little on a strengthening EUR Index.

Tuesday saw another reasonable maximum potential of 610 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 61 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 21, 2021 | Daily Results

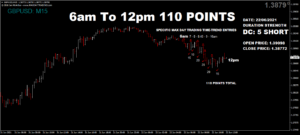

From the UK open we were fully aware that technicals were going to be against us, with the USD & JPY Indexes at the top of the H4 chart and the GBP & AUD at the bottom. The GBP further rebounded on more positive Covid fundamentals, as the government hinted the lockdown should not extend past the earlier date of July 16th. Luckily our early trades were not affected and we still had some decent points at our usual times. However by mid-morning it was clearly evident the GBP intraday sentiment was long and net closes were above our Dom short expectations.

The best ICS Balance was the Dom long EUR/AUD but again, the AUD rebound from major support slowed the trend momentum but good points were still available.

On Friday gone, the German Dax saw the largest one day drop since January which brought the index to the bottom of the H4 chart and technically well oversold. Again we had some decent early trades but an expected net long come the US open.

Monday saw a reasonable though manic maximum potential of 520 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 17, 2021 | Daily Results

Our GBP pairs were reflective of just how accurate the Dom trend predictions are. We had the GBP/JPY & GBP/USD predicted as short and GBP/AUD predicted as long – and that’s EXACTLY what we got throughout not only the UK morning session, but right up to the US close time of 21.00 BST (16.00 EDT). Needless to say there were some very decent points available in all pairs.

Our GBP pairs were reflective of just how accurate the Dom trend predictions are. We had the GBP/JPY & GBP/USD predicted as short and GBP/AUD predicted as long – and that’s EXACTLY what we got throughout not only the UK morning session, but right up to the US close time of 21.00 BST (16.00 EDT). Needless to say there were some very decent points available in all pairs.

The Dom short EUR/AUD suffered with a poor ICS Balance and the Dom short German Dax had another roller-coaster of a day but still good points were had in both.

Thursday saw a marked improvement with a maximum potential of 750 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 75 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 16, 2021 | Daily Results

Individual currency strengths are doing us no favours atm, with conflicts, meandering prices and little trend momentum. There was an initial boost at the start of the UK morning session with positive UK economic data, though this only benefited our Dom long pair but there were still feasible points in all.

Negative EU economic data also put a spanner in the works of our Dom long EUR/AUD but still we had some decent early trades.

The Dom short Dax had another roller-coaster ride with an expected fall from the open but then a sharp reversal leading up to the US open.

Wednesday saw a slight reduction, with a maximum potential of 410 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 41 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 15, 2021 | Daily Results

The initial strength of the GBP Index wasn’t expected to last long after the UK open, even after positive UK data. After the initial climb from bots’ and algos’ the pound dropped on the conformation of a delay in ‘freedom day’ which was scheduled for 21st June. This is now going to be put off for a minimum of 2 to a maximum of 4 weeks but with the way this government is working, a further extension wouldn’t surprise. This limited point gains in our Dom long GBP pairs but we still had some decent early points at our usual times.

The Dom long EUR/AUD had a fair ICS Balance and this reflected in a more solid trend and good points.

The Dom long Dax had another roller-coaster ride on positive German economic data but volumes in all instruments remain painfully low.

Tuesday saw a reduced maximum potential of 455 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 45 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jun 10, 2021 | Daily Results

We knew from the onset that momentum was going to be restricted in our currency pairs today, as all individual indexes were mostly all showing weakness of some sought. However, the Doms comfortably gave very decent points at our usual times.

The Dom short German Dax was immediately red-flagged, trending against the Dom long US30, JPN225 and FTSE100. However there were still a few decent trades available at our usual times.

Thursday saw another reasonable maximum potential of 560 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 56 net points from specific Max Day Trading time/trend entries, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.