by Ian McArthur | Aug 11, 2021 | Daily Results

Individual currency indexes (ICS Balances) were a little better today but we are continuing to suffer from very low volumes and volatility. There was just expected German data on the economic front relating to the Dom long Dax, with some nice points to be had.

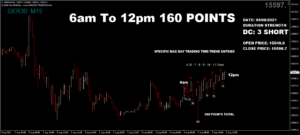

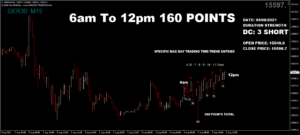

Wednesday saw a slight improvement with a maximum potential of 420 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 42 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Aug 10, 2021 | Daily Results

2 individual currencies made life very difficult today, namely the GBP Index and the AUD Index. They both started on the weak side but became ‘Pluses’ not long after the UK open, limiting momentum and our point gains. Thankfully these phenomenons are rare.

The Dom long Dax fared well on negative German data with some decent points available.

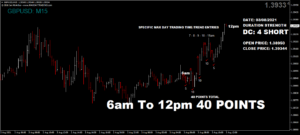

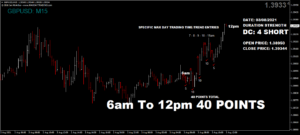

Tuesday saw a reduced maximum potential of 400 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 40 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Aug 10, 2021 | Daily Results

by Ian McArthur | Aug 5, 2021 | Daily Results

Negative UK economic data had the strange effect of strengthening the GBP index. This reflected in decent points for our Dom long pairs and not so good for our Dom short pair.

Individual currency strength (ICS) Balance was in conflict within the EUR/AUD but we still had some decent points at our usual times, as did the Dom long Dax on positive German data.

Thursday saw a slight decrease on yesterday, giving a maximum potential of 520 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 52 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Aug 4, 2021 | Daily Results

Even though our GBP pairs were intraday trending in opposite directions, Dom technical analysis predictions were absolutely spot on with good points in both directions.

The Dom short EUR/AUD and the Dom long Dax performed very well, despite negative German economic data just before 9am.

Wednesday saw an improved maximum potential of 590 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 59 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Aug 3, 2021 | Daily Results

Covid fundamentals played a big part in the GBP Index, restricting the points that were available from our Dom short GBP pairs. The index started the day weak but an earlier article mentioning a lifting of all holiday restrictions was bound to lift the UK pound, which it eventually did. There were still some early trades at our usual times but overall points were well down.

The EUR/AUD & Dax were very much ‘non-directional’ with limited points too.

Tuesday saw another reduced maximum potential of 460 points from specific Max Day Trading time/trend entries within our five instruments from the UK morning session alone, with a minimum target of just 30.

JUST A TEN PERCENT target of this figure would have yielded 46 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.