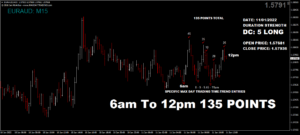

by Ian McArthur | Jan 12, 2022 | Daily Results

Volumes and volatility remain on the low side with little momentum anywhere. There was some early (7am) negative German data of which the price reaction of the Dom long Dax didn’t kick in until after 8am. After an initial climb, the price plummeted before recovering for our 9am trade and some excellent points to boot.

Wednesday saw another reasonable maximum potential of 475 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 95 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

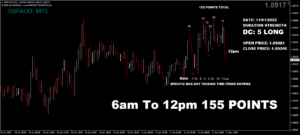

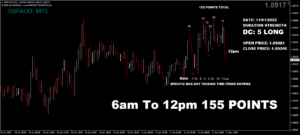

by Ian McArthur | Jan 11, 2022 | Daily Results

ICS Balances warned us before the UK session even started, that momentum within our currency pairs would be restricted. Some were better than others and we trades accordingly with decent points at our usual times.

The Dom short German Dax did well in the early hours but a ‘hawkish’ presidential speech at 10am lifted the index up to the end of the UK morning session.

Tuesday saw another reasonable maximum potential of 630 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 126 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

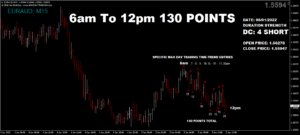

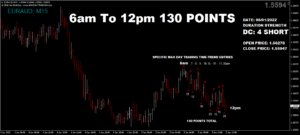

by Ian McArthur | Jan 10, 2022 | Daily Results

Volumes and momentum remain on the low side since the holidays, making point gains far from easy. However there were still some good trades at our usual times, even in our JPY related pairs due to an unusual strengthening in the UK morning session.

The Dom short German Dax took a little while to react but come 8 to 9.15am, the price dropped like a stone.

Monday saw a reasonable maximum potential of 650 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 130 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

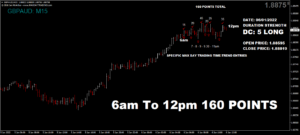

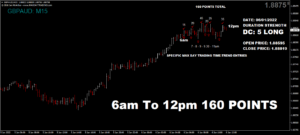

by Ian McArthur | Jan 6, 2022 | Daily Results

UK & German economic data gave us ‘swings & roundabouts’ within our instruments today. The Dom long GBP pairs did well on positive UK data, however positive German data went against our Dom short Dax. Decent points were still available once the data wore off and we are also seeing increased volumes and volatility.

Thursday saw another reasonable maximum potential of 725 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 145 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

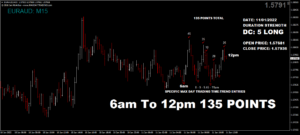

by Ian McArthur | Jan 5, 2022 | Daily Results

ICS Balances were far from ideal today, with some being an oughtright conflict. However points at our usual times were still plentiful where balances were more favourable.

The Dom long Dax did very well on positive German data, giving strong momentum up to the end of the UK morning session.

Wednesday saw another reasonable maximum potential of 640 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 128 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.