by Ian McArthur | Feb 2, 2022 | Daily Results

The markets continue to consolidate on poor ICS Balances. Again and ironically, it was the GBP/USD that gave best momentum on a decent ICS Balance. Despite all this, decent points were still available at our usual times.

Wednesday saw a reduced maximum potential of 470 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 94 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 1, 2022 | Daily Results

ICS Balances immediately informed us of instability and manic price movements, with little trend momentum within our currency pairs. Days like this you you can either take your chances or wait until better balances return. Early positive UK economic data played havoc with our Dom short GBP pairs, as this lifted the GBP Index from the onset. Decent points were still available at our usual times but these were not the easiest.

The Dom long Dax bucked the trend on negative German economic data, meaning that the price unexpectedly continued to rise.

Tuesday saw another reasonable maximum potential of 695 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 139 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

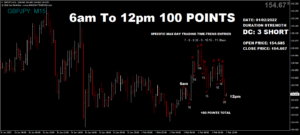

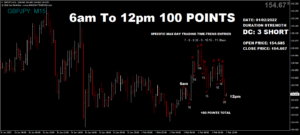

by Ian McArthur | Jan 31, 2022 | Daily Results

We were fully aware before we started trading today that due to an ICS Balance conflict, the Dom long GBP/AUD and EUR/AUD would struggle with momentum as strong currencies within pairs battled it out. The only decent pair was the Dom long GBP/JPY which still had a conflict but nowhere near as bad as the former. A weakening JPY Index helped the long trend up to the end of the UK morning session, which then saw the GBP drop like a stone after 12pm.

Early Dom long Dax trades were decent but manic as usual, however negative EU GDP data brought the index down in the latter part of the morning session, with a net short come the start of the NY session.

Monday saw a reasonable maximum potential of 610 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 122 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jan 29, 2022 | Weekly Roundup

ICS Balances favoured the GBP/AUD & EUR/AUD, again with knowledge of this before the UK morning session started. This reflected in strong trends and excellent points from both pairs.

The conflict was in the GBP/JPY, as a strong GBP Index did battle with a strengthening JPY Index. However we still had some decent points at our usual times, with a net long come the end of the UK morning session.

The Dom long Dax suffered on negative German economic data and although earlier points were feasible and available, there was little confidence in long trades.

Friday saw another very reasonable maximum potential of 720 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 144 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Jan 27, 2022 | Daily Results

GBP/AUD & EUR/AUD both had conflicting ICS Balances before the UK session started, notifying us of manic movements and little momentum. However we still had some decent points at our usual times. The GBP/JPY gave our best points in our currency pairs on a slightly better ICS Balance and would have been our first choice this morning.

The Dax did very well on early positive German data and again volumes and volatility are very high, making for some nervous trading due to the manic nature of the price movement.

Thursday saw another very reasonable maximum potential of 855 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 171 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.