by Ian McArthur | Feb 9, 2022 | Daily Results

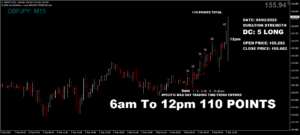

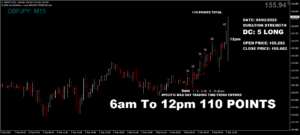

Despite poor ICS Balances within our currency pairs, technical Dom trend directions were still decent and points were good at our usual times. A good example today was the Dom long GBP/JPY and Dom short AUD/USD. Both gave good points in opposite trend directions.

The Dom short EUR/AUD did well but the surprise was the technically Dom long Dax, which totally ignored very negative early German economic data, with the price rising strongly to the end of the UK morning session.

Wednesday saw a reasonable maximum potential of 670 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 134 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 8, 2022 | Daily Results

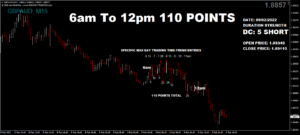

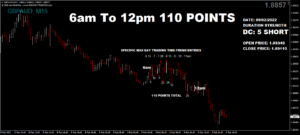

The markets continue to consolidate, with poor ICS Balances keeping trend momentum in our currency pairs to a minimum.

Volatility has also decreased with little economic data to stir the pot. Thankfully there were still dome very decent points available at our usual times.

Tuesday saw a reasonable maximum potential of 655 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 131 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 7, 2022 | Daily Results

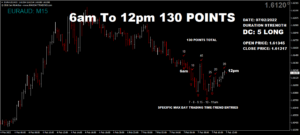

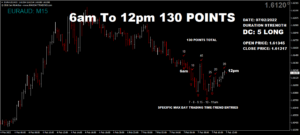

Early negative UK & German economic data set the tone for the UK morning session, benefiting or Dom short pairs and hampering our Dom longs. Good points were available at our usual times.

Even our Dom long pairs did okay under the circumstances with some very decent points.

Monday saw a decent maximum potential of 780 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 156 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 5, 2022 | Weekly Roundup

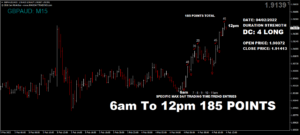

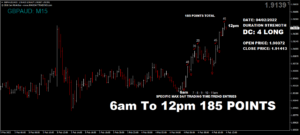

The best ICS Balance within our currency pairs was again the EUR/AUD, with a strong EUR Index and a weak AUD index. Again we were informed of the strong long momentum before the UK open. Other balances were not as good so more reliance was placed on our Dom technical analysis and we still had good points at our usual times.

The Dom short Dax totally ignored positive German data, with the biggest one day loss this year so far, with some eye watering points were available.

Friday saw a very respectable maximum potential of 1,030 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 206 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 3, 2022 | Daily Results

Despite poor ICS Balances within our currency pairs today, Dom trend technical analysis saw definitive movements throughout the whole of the UK morning session. The strength of the GBP Index was influenced by the expectation of an Interest Rate forecast at 12pm. Once this was confirmed, the GBP shot up but has since settled. Our Dom long GBP pairs did well, on slightly manic movements with volatility remaining on the low side.

The Dom long EUR/AUD remained in consolidation mode, due to a similar Interest Rate decision, though this time the forecast remained the same as the previous. Decent points were still available at our usual times.

The Dom short Dax did well but again, volatility and the typical manic nature of the price movement made entries far from easy, though some very good points were available.

Thursday saw an improved maximum potential of 590 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 118 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.