by Ian McArthur | Feb 16, 2022 | Daily Results

The markets became jittery today as several reports of Russian troops reassembling close to the Ukrainian boarder. This kept volumes down and saw a selloff of stocks worldwide.

Currency pairs went into consolidation mode, with poor ICS Balances and little momentum anywhere. Thankfully our technical Dom trend predictions gave some decent trades at our usual times.

Wednesday saw another reasonable maximum potential of 690 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 138 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

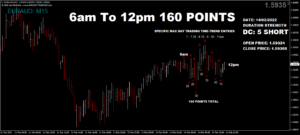

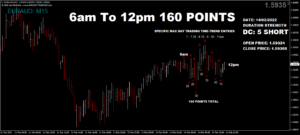

by Ian McArthur | Feb 15, 2022 | Daily Results

Early positive UK economic data gave our Dom long GBP pairs a bit of a push this morning but the news had little effect on our technically Dom short GBP/AUD, with very good points available in both directions. This was the same for the Dom short EUR/AUD, which was helped along with a strengthening AUD Index.

The Dom short Dax gave us a couple of early trades but even negative German data did nothing to stop the advance after a news article stating that the Russians were withdrawing troops from the Ukrainian border.

Tuesday saw a reasonable maximum potential of 530 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 106 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 14, 2022 | Daily Results

A lack of economic data is keeping the markets in consolidation mode but at least our technical Don trend conclusions are still coming up with the goods – and points. ICS Balances within our currency pairs are still far from perfect but still giving moderate trend momentum.

The German Dax continued to plummet along with most indices, with increasing volatility and excellent points.

Monday saw a further improved maximum potential of 1,150 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 230 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 11, 2022 | Weekly Roundup

The markets continue to consolidate with little overall volatility. There were some very unusual price movements within most our currency indexes during the Asia session, reflecting in far from ideal balances and restricted points from within in our pairs. Mixed UK economic data at 7am added to the lack of trend momentum. Despite this, decent points were still available at our usual times.

The Dom short Dax was given a general lift on expected German CPI economic data.

Friday saw an improved maximum potential of 730 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 146 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 10, 2022 | Daily Results

Individual currency strengths within our pairs (ICS Balance) were far from ideal today. Early positive UK housing data, along with a ‘hawkish’ speech from the Bang of England governor gave increasing strength during the UK morning session and limiting trend momentum in our Dom short GBP pairs.

The Dom short EUR/AUD did well at our usual times, as did the Dom long German Dax.

Thursday saw a decent maximum potential of 555 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TWENTY PERCENT target would have yielded 111 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.