by Ian McArthur | Mar 2, 2022 | Daily Results

The influence from the eastern Europe conflict continues to dominate market sentiment, as risk is transferred from stocks to currencies depending on the severity of the situation. Positive UK economic data lifted the GBP slightly, restricting points from our Dom long pairs.

The Dom short EUR/AUD did well on a decent ICS Balance, with the Dom short Dax gaining ground on positive German data.

All in all, there were some decent points in all our instruments at our usual times.

Wednesday saw another very decent maximum potential of 990 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 99 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

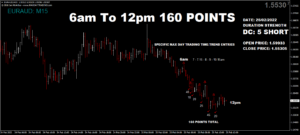

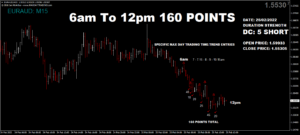

by Ian McArthur | Mar 1, 2022 | Daily Results

The situation in eastern Europe dominated the markets again today, with risk being transferred from stocks to currencies as the situation between Russia and the Ukraine deteriorates. This was clearly evident in falling stocks and rising oil.

This made ICS Balances within our pairs far from ideal, with momentum and overall points being restricted. However good points were still available at our usual times.

Our main casualty today was our initially Dom long Dax, which started to plummet as soon as news came in of the conflict severity. There were a couple of decent early trades and late trades but overall, the later trades were risky but feasible.

Tuesday saw another very decent maximum potential of 760 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 76 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 28, 2022 | Daily Results

We start another week with high tensions in eastern Europe, with swings in stocks and oil. Both are indicating a ‘less severe’ situation with rising stocks and falling oil. Our technical Domino Effect (Dom) analysis again proved very well under such volatile conditions, with some excellent points at our usual times in all our instruments.

Monday saw another very decent maximum potential of 1,020 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 102 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 26, 2022 | Weekly Roundup

There are confusing signals coming from the eastern European crisis, with MSM pushing the narrative of a full scale invasion and other sources saying it’s only the liberation of two breakaway areas that want to rejoin Russia.

Two huge indications of the severity of the situation are the price of stocks and oil. When things are genuinely bad, stocks plummet and oil shoots up. However Friday saw a reversal of this scenario. I’ll let you make your own minds up!

Despite all this, our Dom trend conclusions have remained reliable in all our instruments, with excellent points available at our usual times.

Friday saw another high but manic maximum potential of 1,000 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 100 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.

by Ian McArthur | Feb 24, 2022 | Daily Results

The markets and especially stocks are now suffering from very high volatility, as the crisis in eastern Europe deepens. Investors and traders are bailing out, causing some eye watering but manic points – if you got it right!

The Dom short German Dax gave some excellent points but trade entries were far from precise.

All our currencies were Dom short and again, the huge sell-offs caused dome very good but manic points at our usual times.

Because of this high volume/volatility situation, I have reduced the percentage of our overall points from 20% to 10%. This shall remain until volumes and volatility reduce to nearer their normal levels.

Thursday saw another high but manic maximum potential of 1,610 from specific Max Day Trading time/level entries within our four instruments from the UK morning session alone.

JUST A TEN PERCENT target would have yielded 161 net points, with many additional opportunities in the US morning (UK afternoon) and US afternoon (UK evening) sessions.